Tax Commissioner Brian Kroshus speaks with Flag Family News Reporter Chris Larson

BISMARCK, N.D. – The application window has opened for North Dakota’s $1,600 Primary Residence Credit (PRC) through the North Dakota Tax Department.

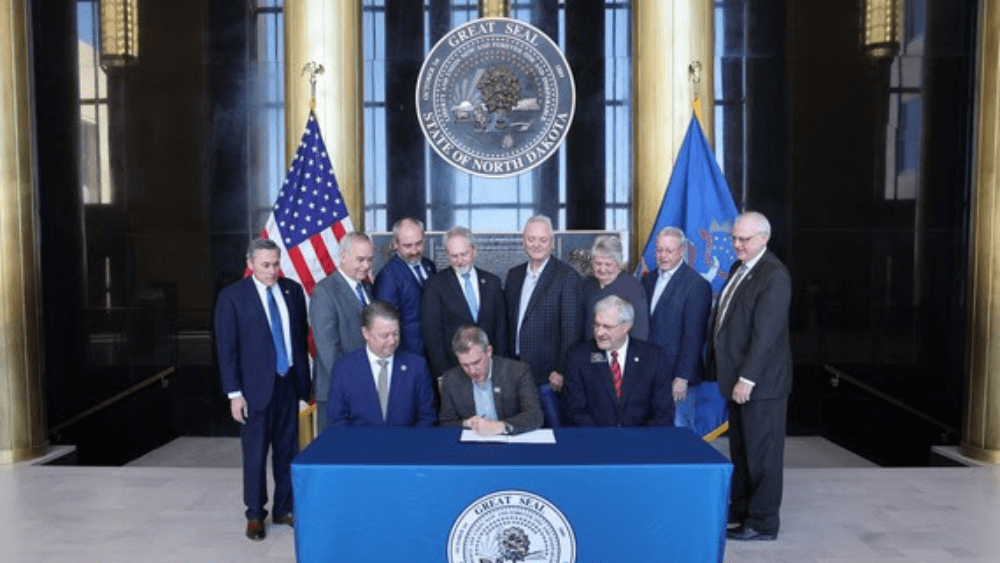

The Primary Residence Credit was established during the 2023 Legislative Session under House Bill 1158 and allows eligible homeowners to apply each year through the North Dakota Office of State Tax Commissioner. During the 2025 Legislative Session, the passage of House Bill 1176 approved a landmark property tax relief measure with part of the bill increasing the PRC from $500 to $1,600 annually.

Tax Commissioner Brian Kroshus said this year’s interest ‘is outpacing where we were last year in terms of where we were at at this time.”

As of early Thursday morning, the state had received more than 70,000 applications for the PRC.

“Without question by end of week, we’ll probably be at or beyond the midpoint in terms of what we expect to receive in applications,” Kroshus said.

The deadline is April 1.

He said the Tax Department is spreading the word about the PRC through ‘literally every available type of media,’ including newspapers, television, radio and social media networks.

The Tax Department is also monitoring the success on a county-by-county basis – checking into percentages of participants.

“If we see a county that maybe we want to see the numbers going up a little bit more, keeping pace with their counterparts, we’ll heavy up a little bit more on the messaging,” Kroshus said.

Most of the individuals taking advantage of the PRC in 2026 have been repeat applicants. In 2025, participation rates were 95 percent.

As the state continues to grow, so does housing – which means more opportunities for families to participate in the PRC program.

“On average, 3,000 to 4,000 new homes will be constructed in the state each year,” Kroshus said. “Those predominantly are primary residence households.”

Staff at the North Dakota Tax Department are not experiencing any backlog with the increased interest in the program, he said.

“The call wait time, the longest period in terms of call wait was right around the two-minute mark, and it’s been reduced from that,” Kroshus said. “The team is doing a terrific job.”

Most of the renewals and applications are being done online, he said.

“But for those who don’t have access to a computer or would just rather do it over the phone, we’ve got operators standing by,” Kroshus said.